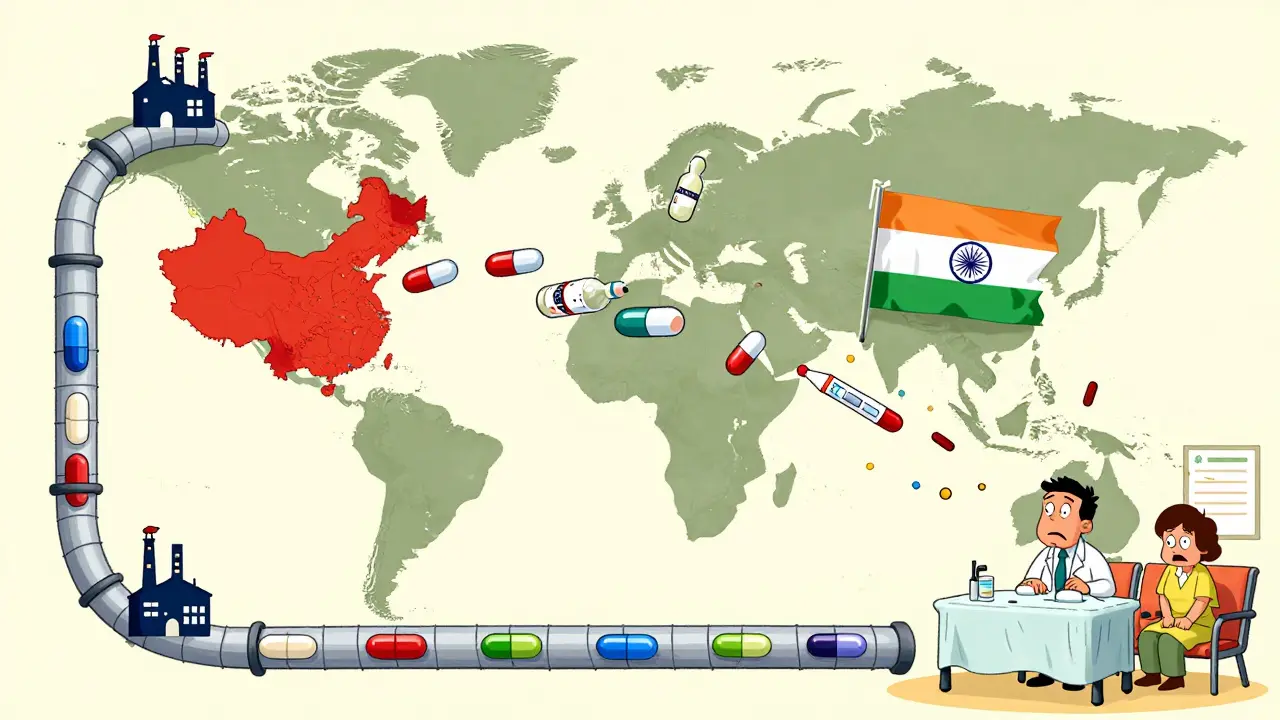

Drug shortages aren’t random accidents. They’re the result of fragile systems that were built for efficiency, not safety. When a single factory in India shuts down for a regulatory issue, or a shipment of active pharmaceutical ingredients (APIs) gets stuck in a port due to geopolitical tension, patients across the U.S., Australia, and beyond are left without life-saving medications. Insulin. Antibiotics. Chemotherapy drugs. These aren’t luxuries-they’re necessities. And the system keeping them flowing is cracking under pressure.

Why the Current System Keeps Failing

For decades, pharmaceutical companies chased the lowest cost. That meant outsourcing API production to China and India, where labor and regulations were cheaper. Today, about 80% of APIs and 40% of finished drugs consumed in the U.S. come from overseas. China alone supplies 45% of these critical ingredients. India adds another 23%. That’s not diversification-it’s dependence. When the pandemic hit, this dependence became a crisis. Factory closures, export bans, and shipping delays caused shortages of everything from antibiotics to heart medications. The U.S. FDA confirmed that over 150 drugs were in short supply at the peak. Hospitals rationed doses. Patients skipped treatments. Emergency rooms turned away people who needed basic meds. The problem isn’t just foreign factories. It’s the lack of backup. Most companies operate with just 15-30 days of inventory for critical drugs. That’s not enough to weather a disruption. It’s not even close.What Resilience Actually Means

Resilience isn’t about bringing everything home. It’s about building systems that don’t break when one part fails. The U.S. Department of Health and Human Services defines it clearly: the ability to anticipate, prepare for, respond to, and recover from disruptions while keeping essential medicines flowing. That means three things:- Preparedness: Knowing where your risks are-down to the 12th tier of suppliers.

- Response: Having plans ready to switch suppliers, reroute shipments, or activate emergency stockpiles.

- Recovery: Getting back to normal faster after the crisis passes.

Four Proven Strategies to Build Resilience

There’s no single fix. But four strategies, used together, make a real difference.1. Dual-Sourcing Critical Ingredients

Don’t rely on one supplier for a life-saving drug. Find a second, geographically separate source. Top performers now dual-source 70-80% of their critical APIs. That doesn’t mean doubling costs-it means spreading risk. If one plant goes offline, the other keeps running.2. Build Buffer Stock for Essential Medicines

Keep 60-90 days of inventory for drugs that can’t be easily replaced. That includes insulin, epinephrine, antibiotics, and cancer treatments. The U.S. government is launching a Strategic Active Pharmaceutical Ingredients Reserve to do exactly this-for 150 essential medicines by 2027. But private companies need to act too. A hospital system in Texas started stockpiling vancomycin after a 2024 shortage. They avoided a crisis in 2025 when a key supplier had a quality control failure.3. Invest in Continuous Manufacturing

Traditional drug manufacturing happens in batches. One batch fails? You lose weeks. Continuous manufacturing runs 24/7 in smaller, modular units. It’s faster, cheaper to scale, and uses 20-25% less energy. A single continuous facility can go from design to operation in 12-18 months-compared to 3-5 years for a traditional plant. The catch? It costs $50-150 million to build one. Only 12 FDA-approved continuous manufacturing lines exist today. But that number is rising. The FDA has cut approval times from 3 years to under 18 months for qualified facilities. Companies that adopt this now will lead the next decade.4. Use AI to Predict Disruptions Before They Happen

AI isn’t science fiction here. Leading firms use machine learning to monitor global events-political unrest, weather patterns, port delays, regulatory inspections-and predict which drugs are at risk 60-90 days in advance. One company reduced its surprise shortages by 70% using this system. It doesn’t replace human judgment-it gives it a head start.The Cost of Doing Nothing

Some say resilience is too expensive. But the cost of a shortage is higher. ZS Associates found that companies with strong resilience strategies avoid $14.7 million in lost revenue per major disruption. Hospitals pay more for emergency purchases. Patients suffer. Deaths rise. A 2024 study in the Journal of the American Medical Association linked drug shortages to a 12% increase in mortality for patients on critical chemotherapy regimens. And the financial pressure is real. Resilience investments add 8-12% to the cost of goods sold. But companies that invest 8-10% of their supply chain budget in resilience see a 1.8x return within three years. That’s not a cost. It’s insurance.

Where the Industry Is Headed

By 2027, 45-50% of new manufacturing capacity will use continuous production. Regional networks-North America, Europe, Southeast Asia, Latin America-will supply 65-70% of U.S. drug needs, up from 55% today. Domestic API production will climb from 28% to 35-40%. But here’s the truth: no country can make every drug alone. The goal isn’t isolation. It’s balance. A global network, yes-but with strategic backups. A U.S. facility for insulin. A Canadian plant for antibiotics. A Singapore-based partner for oncology drugs. And buffer stock for all of them. The companies that survive the next crisis won’t be the cheapest. They’ll be the most prepared.What You Can Do Now

If you’re in healthcare, pharmacy, or supply chain management, here’s where to start:- Map your top 10 critical drugs. Which APIs do they rely on? Where are they made?

- Check your inventory levels. Do you have more than 30 days of stock for any of them?

- Ask your suppliers: Do you have a second source? What’s your contingency plan?

- Push for data integration. If your procurement, logistics, and inventory systems don’t talk to each other, you’re flying blind.

- Start small. Pick one high-risk drug. Build a dual-source plan. Stock 60 days of inventory. Test it.

What causes most drug shortages today?

Most drug shortages stem from disruptions in the supply of active pharmaceutical ingredients (APIs), which are often produced in just one or two overseas facilities-mostly in China and India. A single regulatory inspection, natural disaster, or export ban can halt production. Poor inventory planning, lack of alternative suppliers, and over-reliance on just-in-time manufacturing make these disruptions far worse than they need to be.

Is bringing drug manufacturing back to the U.S. the solution?

Not entirely. While increasing domestic production helps-U.S. output rose from 22% to 28% of APIs between 2022 and 2025-it’s not practical or affordable to make every drug locally. The real solution is strategic diversification: building regional manufacturing hubs and dual-sourcing critical ingredients across multiple countries. Over-relying on one domestic supplier creates new risks. Resilience means balance, not isolation.

How much inventory should pharmacies keep for critical drugs?

For essential medicines like insulin, antibiotics, or heart medications, 60-90 days of inventory is the recommended buffer. That’s far more than the typical 15-30 days most facilities hold. While holding more stock increases upfront costs, it prevents life-threatening shortages during disruptions. Hospitals and large pharmacy chains that adopted this practice saw 70% fewer emergency orders and better patient outcomes.

What role does AI play in preventing drug shortages?

AI helps predict disruptions before they happen. By analyzing global data-weather, politics, shipping delays, factory inspections-AI models can flag which drugs are at risk 60-90 days in advance. One major pharmaceutical company reduced surprise shortages by 70% using this approach. It doesn’t replace human decisions; it gives them time to act.

Are continuous manufacturing systems worth the investment?

Yes, for high-demand or critical drugs. Continuous manufacturing cuts production time by 30-40%, reduces waste by 15-20%, and uses less energy. While the upfront cost is $50-150 million-3-5 times more than traditional plants-it pays off in speed, flexibility, and reliability. The FDA is speeding up approvals for these systems, making them more accessible. Companies using them recover from disruptions 50% faster.

How are governments helping to fix this problem?

The U.S. government has committed over $2 billion since 2023 to strengthen pharmaceutical supply chains, including funding for domestic API production and a new Strategic Active Pharmaceutical Ingredients Reserve. The reserve aims to stockpile 90 days of essential medicines by 2027. Other countries, including Australia and the EU, are following similar paths, though at different speeds. These efforts are helping, but private sector action is still the biggest driver of change.

Alex Danner

Let’s be real - we’ve been dancing on a knife’s edge for years. I’ve seen hospitals ration insulin like it’s gold in a war zone. And it’s not just about outsourcing - it’s about pretending that global supply chains are bulletproof. One factory in Hyderabad, one FDA inspection, one shipping delay - and people die. We need buffer stock, not just hope. The 60-90 day rule isn’t optional. It’s survival. And if your pharmacy still runs on ‘just-in-time’ magic, you’re not efficient - you’re reckless.