When a new drug hits the market, it doesn’t just have a price tag-it has a clock. And that clock is ticking down on two very different kinds of protection: patent exclusivity and market exclusivity. They sound similar, but they’re not the same. One comes from the patent office. The other comes from the FDA. And if you don’t understand the difference, you’re missing how drugs stay expensive, why generics take so long to appear, and how companies stretch their profits far beyond what the law originally intended.

Patent Exclusivity: The Legal Shield

A patent gives a company the right to stop others from making, selling, or using their invention. In pharma, that usually means the chemical formula, how it’s made, or how it’s used to treat a disease. The U.S. Patent and Trademark Office (USPTO) grants this. And by law, it lasts 20 years from the day the patent is filed.

But here’s the catch: drug development takes forever. On average, it takes 10 to 15 years just to get a new drug from the lab to the pharmacy shelf. That means by the time a drug is approved by the FDA, a company might only have 5 to 10 years left on its patent. That’s not enough to recoup the $2.3 billion it cost to develop the drug.

To fix this, the law lets companies apply for Patent Term Extension (PTE). This adds back some of the time lost during FDA review. But there’s a cap: you can’t extend past 14 years after FDA approval, and no more than 5 years can be added. So if your patent was filed in year one and approval came in year 13, you might get 1 year of extension-giving you 14 years of market control from approval.

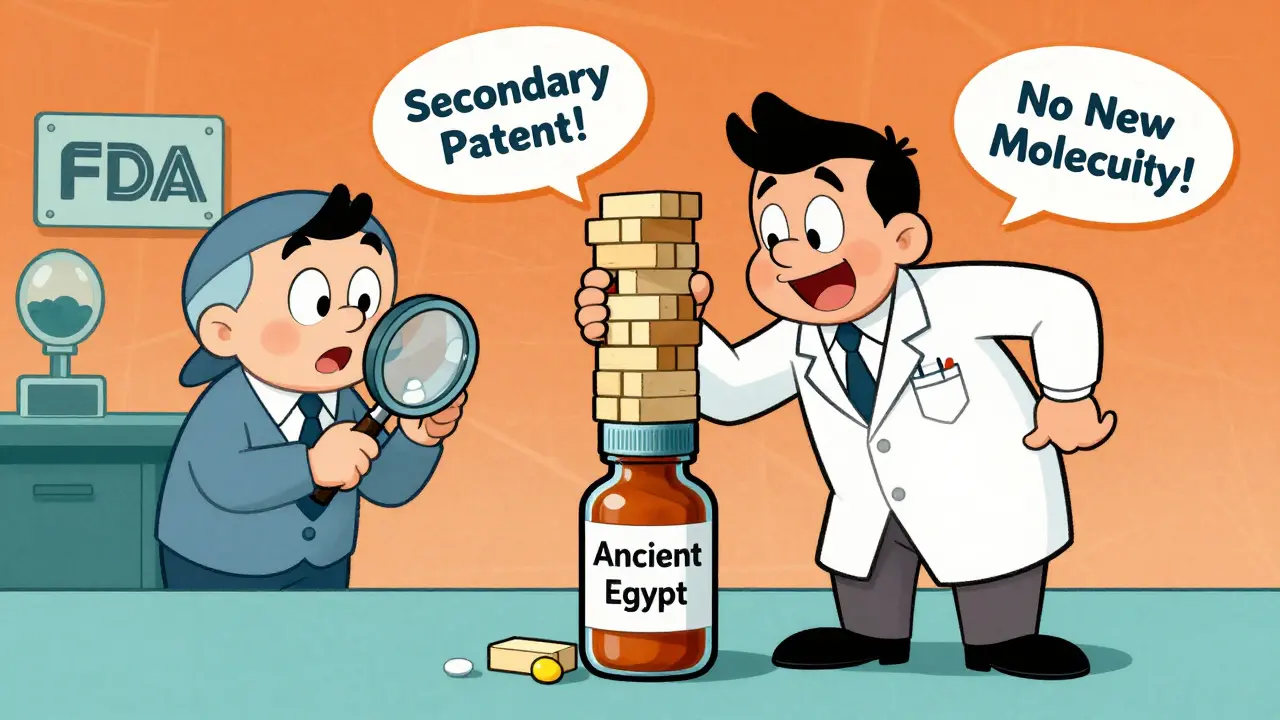

Patents can be tricky. The strongest protection is a composition of matter patent-that covers the actual molecule. But many companies file secondary patents instead: for new dosages, delivery methods, or uses. These are easier to get, harder to challenge, and often keep generics out even after the main patent expires. In fact, 68% of patents listed in the FDA’s Orange Book are secondary patents, not the original formula.

Market Exclusivity: The FDA’s Gatekeeper

Market exclusivity has nothing to do with patents. It’s a separate protection granted by the FDA. It doesn’t care if your drug is new or old. It cares if you submitted new clinical data to get approval.

The most common type is New Chemical Entity (NCE) exclusivity. If your drug contains a molecule no one’s ever approved before, the FDA can’t accept any generic application for 5 years. Even if someone else files a generic version on day one, the FDA won’t even look at it until year five.

Then there’s orphan drug exclusivity. If you develop a drug for a rare disease (affecting fewer than 200,000 people in the U.S.), you get 7 years of market exclusivity-even if there’s no patent. That’s why drugs like Zolgensma, which costs over $2 million per dose, can stay monopoly-priced for so long.

Biologics-complex drugs made from living cells-get 12 years of exclusivity under the BPCIA of 2009. That’s longer than most patents last. And if you add pediatric studies, you get an extra 6 months. That 6-month bump has generated over $15 billion in extra revenue since 1997.

Here’s the kicker: market exclusivity doesn’t require novelty. In 2010, Mutual Pharmaceutical got 10 years of exclusivity for colchicine-a drug used since ancient Egypt. The FDA approved it as a new use for gout, even though the molecule itself was centuries old. The price jumped from 10 cents to nearly $5 per tablet. No patent. Just exclusivity.

How They Work Together (or Don’t)

Patents and market exclusivity can overlap. They can run at the same time. Or one can end while the other keeps going. That’s why some drugs stay protected for over 20 years.

The FDA tracks this in the Orange Book. Their 2021 analysis showed:

- 27.8% of branded drugs had both patent and market exclusivity

- 38.4% had only patents

- 5.2% had only market exclusivity

- 28.6% had neither

That 5.2%? Those are the drugs with no patents at all. Yet they still had no competition. That’s market exclusivity doing the heavy lifting.

And for generics? The first company to challenge a patent gets 180 days of exclusivity. That’s a huge financial windfall-worth $100 million to $500 million in extra sales. But if the innovator holds a separate regulatory exclusivity, that 180-day window doesn’t open until the exclusivity expires.

Teva Pharmaceuticals learned this the hard way with Trintellix, an antidepressant. The patent expired in 2021, but the FDA had granted 3 years of exclusivity. Teva couldn’t launch its generic until 2024. They lost an estimated $320 million in revenue.

Why It Matters to Patients and Payers

The global pharmaceutical market hit $1.42 trillion in 2022. Branded drugs make up 68% of that revenue-even though they’re prescribed in only 12% of cases. Why? Because exclusivity keeps prices high.

For patients, that means paying hundreds or thousands for a drug that could be $10 as a generic. For insurers and governments, it means billions in extra spending. The Congressional Budget Office found that every year of extended exclusivity adds over $1 billion to U.S. healthcare costs.

And it’s getting worse. In 2022, 58% of new drugs had no composition-of-matter patent-but still got regulatory exclusivity. That means the system is shifting from innovation-based protection to data-based protection. Companies are now designing drugs to fit exclusivity rules, not to cure diseases.

Small biotech firms are especially vulnerable. A 2022 survey found 43% of them mistakenly thought patent protection meant market exclusivity. They spent millions on patent filings, only to realize the FDA could still block generics even if their patent was weak or expired.

What’s Changing? Transparency and Reform

Starting January 1, 2024, the FDA requires companies to give much more detailed justifications when claiming exclusivity. No more vague claims. You need to prove exactly which studies you did and why they’re new.

The FDA also launched its Exclusivity Dashboard in September 2023. Now anyone can see which drugs have exclusivity, when it expires, and what type it is. That’s a win for generics. It’s also a warning to innovators: hiding behind loopholes is getting harder.

Legislation is catching up too. The PREVAIL Act of 2023 proposes cutting biologics exclusivity from 12 to 10 years. And global debates are growing-especially around whether COVID-style patent waivers should apply to other drugs.

McKinsey predicts that by 2027, regulatory exclusivity will account for 52% of total market protection time-up from 41% in 2020. Patents are losing ground. Exclusivity is winning.

What You Need to Know

- Patents protect inventions. Market exclusivity protects the approved drug product.

- Patents can expire. Market exclusivity doesn’t care-it still blocks generics.

- Even if a drug has no patent, it can still have 5, 7, or 12 years of protection.

- Secondary patents and data exclusivity are now the main tools for extending monopolies.

- The FDA’s exclusivity rules are becoming stricter-and more transparent.

If you’re a patient, know that your drug’s price isn’t just about R&D-it’s about legal loopholes. If you’re in pharma, understand that exclusivity isn’t automatic. You have to claim it. And if you miss it, you lose years of revenue.

There’s no single answer to high drug prices. But if you want to understand why they stay high, start with the difference between patent and market exclusivity. One is a legal right. The other is a regulatory rule. And together, they’re the real reason generics are still waiting.

Can a drug have market exclusivity without a patent?

Yes. A drug can get market exclusivity even if it has no patent. For example, colchicine-used for centuries-received 10 years of FDA exclusivity in 2010 for a new use, even though its chemical structure was never patented. Orphan drugs, biologics, and drugs with pediatric studies can also get exclusivity without any patent protection.

How long does FDA market exclusivity last?

It depends on the drug type. New Chemical Entities get 5 years. Orphan drugs get 7 years. Biologics get 12 years. Pediatric exclusivity adds 6 months to existing exclusivity or patent terms. First generic applicants who challenge a patent get 180 days of exclusivity.

Does patent extension affect market exclusivity?

No. Patent extension only adds time to the patent term-it doesn’t change FDA exclusivity. Market exclusivity runs on its own clock, based on FDA approval date and drug type. They’re independent systems. A drug can lose its patent but still be protected by exclusivity.

Why do some drugs have multiple patents?

Companies file multiple patents-called patent thickets-to delay generic competition. These include patents on formulations, dosing schedules, or new uses. Even if the original molecule patent expires, these secondary patents can block generics for years. The FTC found that 68% of patents listed in the Orange Book are secondary patents.

Can a generic drug enter the market before exclusivity ends?

No. The FDA is legally barred from approving a generic application until all applicable exclusivity periods expire-even if the patent has expired. Generic companies often file applications early, but the FDA won’t review them until exclusivity ends. This is why some generics launch years after patent expiry.

Lauren Wall

This is why drugs cost a fortune. Companies aren't innovating-they're gaming the system. Patents? Pfft. It's all about loopholes now.