When you hear "ACA plans," you might think of cheap health insurance. But the truth is more complicated. The Affordable Care Act didn’t just make insurance cheaper-it changed what insurance even means. If you’re signing up for a plan through HealthCare.gov, or you’re trying to figure out if you qualify for help, you need to know what’s actually covered, what’s changing, and who it really works for.

What the ACA Actually Covers (No Fluff)

The ACA doesn’t let insurers skip the basics. Every plan sold on the Marketplace must include ten essential health benefits. That’s not a suggestion. It’s the law. These include:- Ambulatory patient services (doctor visits)

- Emergency care

- Hospitalization

- Pregnancy, maternity, and newborn care

- Mental health and substance use disorder services

- Prescription drugs

- Rehabilitative services (like physical therapy)

- Laboratory services

- Preventive and wellness services

- Pediatric services, including dental and vision

This is huge. Before the ACA, insurers could drop coverage for cancer treatment after $1 million in claims. Or refuse to cover birth control. Or charge you more because you had asthma. None of that’s allowed anymore. If you have a chronic condition, this is the biggest win.

How Much You Pay: Metal Tiers Explained Simply

Plans are labeled Bronze, Silver, Gold, or Platinum. These aren’t marketing buzzwords-they tell you how costs are split between you and the insurer.- Bronze: 60% covered by plan. You pay 40%. Lowest monthly premium, highest out-of-pocket if you get sick.

- Silver: 70% covered. This is the sweet spot for people who qualify for cost-sharing reductions. If your income is below 250% of the poverty line, you can get Silver plans with way lower deductibles and copays.

- Gold: 80% covered. Higher premiums, but you pay less when you go to the doctor.

- Platinum: 90% covered. Best for people who need constant care.

Most people don’t realize Silver plans are the only ones that come with extra help if you’re low-income. That’s why someone making $32,000 a year might get a $0 premium Silver plan with almost no copays. That’s not magic. That’s the ACA’s cost-sharing reductions kicking in.

Subsidies Are the Real Game-Changer (But They’re Disappearing)

The biggest reason ACA plans are affordable right now? Tax credits. Thanks to the American Rescue Plan and the Inflation Reduction Act, millions of people got help that wasn’t there before. But those enhanced credits expire at the end of 2025.Here’s what that means:

- A 40-year-old earning $50,000 pays $247/month for a Silver plan with credits. Without them? $534. That’s a $344 monthly jump.

- For a 60-year-old, premiums could spike up to 192% in some states.

- Over 17 million people are enrolled in Marketplace plans. If credits vanish, CMS predicts 15-20% fewer people will sign up in 2026.

This isn’t theoretical. People are already seeing bills pile up. One Reddit user, u/ACA_Warrior, reported a $2,800 medical bill because their income dropped mid-year and they couldn’t adjust their subsidy until tax season. That’s the system’s flaw: it’s built on annual income estimates, not real-time changes.

Who Gets Left Out? The New Rules in 2025

On November 11, 2025, the CMS issued its final rule-and it’s cutting coverage for 550,000 people. DACA recipients are no longer eligible for Marketplace plans. That’s not a loophole. It’s a policy change.Another big shift: the monthly Special Enrollment Period (SEP) for people under 150% of the poverty line is gone. Before, if you lost your job or had a baby, you could sign up anytime. Now, you’re stuck until the next open enrollment-unless you qualify for a different life event.

And if you’re self-employed? Good luck. The system still struggles with variable income. CMS reports a 32% error rate in subsidy estimates for freelancers. You might get $0 premiums now, then owe thousands at tax time if your income changes.

ACA vs. Employer Insurance vs. Medicaid

People assume employer plans are better. Sometimes they are. But not always.- Employer plans: Often cheaper monthly, but you’re locked in. If your job doesn’t offer family coverage, you’re stuck with the "family glitch"-until 2023, when the ACA fixed it. Now, if your employer’s family plan costs more than 9.12% of your income, you can get Marketplace subsidies.

- Medicaid: If you live in a state that expanded it (most have), and you make under 138% of the poverty line, Medicaid gives you better coverage than any Marketplace plan. Lower copays, no deductibles, wider access to specialists.

- ACA plans: Best for people who earn too much for Medicaid but too little to afford private insurance without help. They’re flexible, portable, and cover pre-existing conditions.

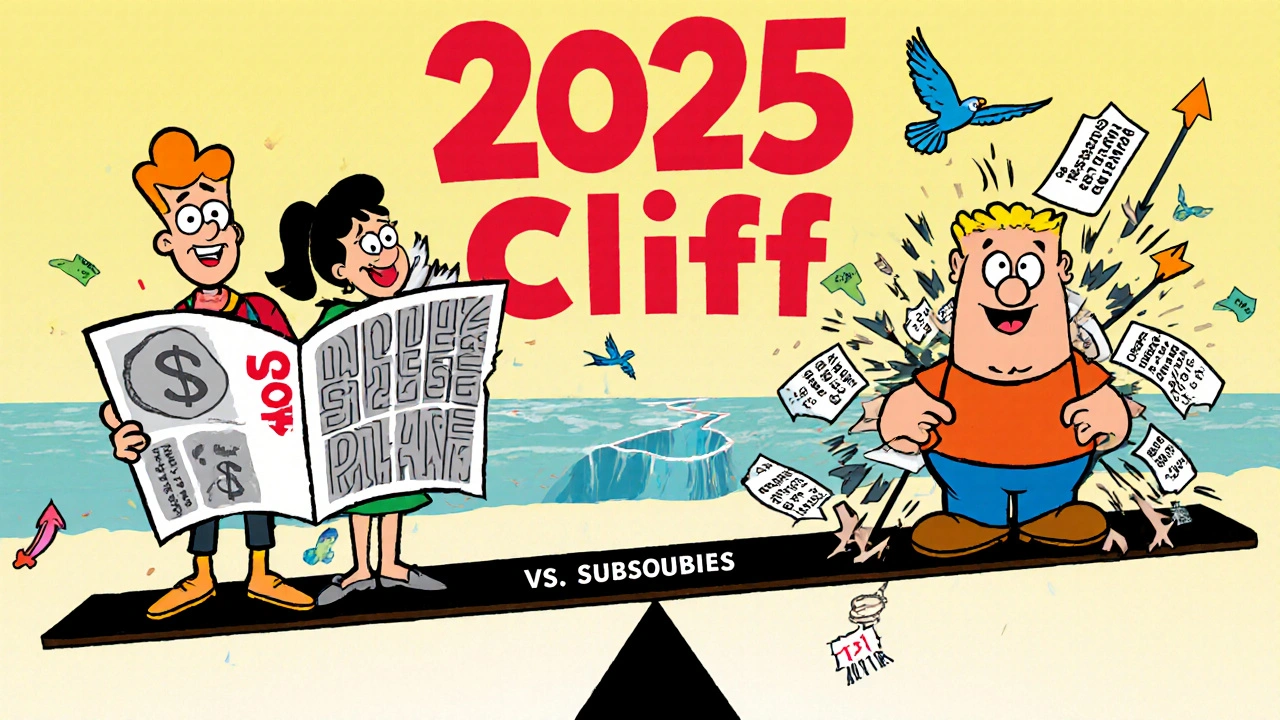

But here’s the catch: if you earn just above the Medicaid limit, you get a subsidy. If you earn $1 too much? You lose everything. That’s the "cliff effect." A 2025 Johns Hopkins study found this pushes people into medical debt.

What’s Next? The 2026 Cliff

The ACA isn’t broken. It’s under pressure. Without Congress extending the enhanced tax credits, premiums will spike. Insurers will pull out of states with high-risk populations. Enrollment will drop. And the cycle will feed itself: fewer healthy people enrolled → higher premiums → more people drop out.Right now, UnitedHealthcare leads the Marketplace with 26% of enrollees. Elevance Health and Molina follow. But if premiums jump 25-35% in 2026, as the Urban Institute predicts, even these giants may retreat.

The CMS says the new income verification rules will cut errors by 40%. That’s good. But it also means more paperwork. Starting in 2026, you’ll need to report income changes quarterly. If you’re a freelancer, that’s a nightmare.

How to Survive the Next Year

If you’re on an ACA plan, here’s what to do now:- Check your 2025 subsidy. If you’re close to the 400% FPL cutoff, you’re at risk.

- Update your income estimates on HealthCare.gov every time your pay changes. Don’t wait for tax season.

- Consider a Silver plan if you qualify for cost-sharing reductions. It’s the only tier with extra help.

- Know your out-of-pocket maximum: $9,450 for individuals in 2025. That’s higher than Medicare Advantage ($8,300).

- Don’t assume your plan covers everything. Check the formulary. Some plans exclude certain diabetes or mental health meds.

People who use the Marketplace often say the same thing: "I never thought I’d get affordable care. Then I got my Silver plan." But that’s only true if the subsidies stay. Without them, the ACA’s promise starts to unravel.

What You Can’t Ignore

The most valued feature of ACA plans? Protection for pre-existing conditions. 92% of enrollees with chronic illnesses say it’s the reason they stayed enrolled. That’s not a policy detail. That’s a lifeline.And yet, the system is fragile. It depends on political decisions. It’s confusing for freelancers. It punishes people who earn a little too much. But for millions, it’s the only way they get care at all.

If you’re reading this, you’re probably one of them. Don’t wait for the system to fix itself. Know your plan. Track your income. Prepare for the change. Because in 2026, what’s affordable today might not be affordable tomorrow.

What’s the difference between a Bronze and Silver ACA plan?

Bronze plans have lower monthly premiums but you pay more when you use care-about 40% of costs. Silver plans cost more each month but cover 70% of your care. If your income is low, Silver plans come with extra help lowering your deductibles and copays, which can make them cheaper overall than Bronze.

Can I get an ACA plan if I’m self-employed?

Yes. Self-employed people qualify for the same subsidies as everyone else. But because your income changes, it’s harder to estimate your subsidy. You’ll need to update your income on HealthCare.gov whenever it shifts significantly. If you don’t, you might owe money at tax time.

Do ACA plans cover prescription drugs?

Yes. All ACA plans must include prescription drug coverage. But each plan has its own formulary-a list of covered drugs. Some plans exclude expensive medications like insulin or mental health drugs. Always check the formulary before choosing a plan.

What happens to my ACA plan if I get a raise?

If your income goes above 400% of the Federal Poverty Level, you lose your subsidy. But you won’t lose your plan. You’ll just pay full price. If your income goes above 150% of the poverty line, you lose cost-sharing reductions, so your deductibles and copays will rise. Update your income on HealthCare.gov to avoid surprises.

Are ACA plans better than Medicare?

Not for people eligible for Medicare. Medicare Advantage plans have lower out-of-pocket maximums ($8,300 in 2025) than ACA plans ($9,450). But ACA plans are better for people under 65 who don’t qualify for Medicare. They cover more preventive services and have no age-based pricing.

Can I get an ACA plan if I’m not a U.S. citizen?

Only if you’re a lawfully present immigrant-like someone with a green card, asylum status, or refugee status. DACA recipients are no longer eligible as of the November 2025 CMS rule change. Undocumented immigrants cannot enroll in ACA plans.

stephanie Hill

Okay but let’s be real - the ACA is just a fancy way to make rich people feel good while the rest of us scramble to pay for insulin. I’ve seen people get denied care because their ‘subsidy’ vanished mid-year. It’s not healthcare, it’s a lottery. And now they’re cutting DACA folks? That’s not policy, that’s cruelty dressed up in spreadsheets.

My cousin got a $4,000 bill after her hours got cut. She didn’t even know she had to update her income every three months. Who designed this system? A bureaucrat who’s never had to choose between rent and pills?